Always online, what do millennials bring to the art market?

In the late 1980s, American writers Otto William Strauss (William Strauss) and Neil Howe (Neil Howe) coined the word "millennial" (millennials), which refers to born from the early 1980s to the mid-1990s. A generation that gradually enters youth or adulthood around the turn of the millennium. At first, it was adopted because of its keen capture of the changes of the times, and the unique choices of the named generation in terms of lifestyle, consumption habits and values made the word have inestimable vitality and influence.

(Generations), William Strauss (William Strauss) and Neil Howe (Neil Howe), published in 1991. In the book, William Strauss and Neil Howe first mentioned the concept of "millennials" and stated their social class theory, which is called "Strauss-Howe intergenerational theory". Source: Amazon.com.

Millennials have recently appeared frequently in several major art market reports. Mark Spiegler, global director of art in Basle, in the preface to Art Basle and UBS Global Art Market report 2019, Referring to the highlights of the report, a special study of millennials between the ages of 22 and 37 found that they entered and participated in the art market in a significantly different way than their predecessors. The author of the report, Dr. Clare Mike Andrew, founder of the Art Economics (Art Economics) and cultural economist, also stressed that this year's report confirms the dynamism of the global millennial collector market. The U.S. Trust's 2018 Insights on Wealth and Worth-Art Collectors), a research report on the U.S. wealth market, reached a similar conclusion.

The Basle Art Market report 2019 shows the age distribution of collectors in five markets (UK, Germany, Japan, Singapore and Hong Kong), of which millennials (millennials) account for 46 per cent and 39 per cent of collectors in Singapore and Hong Kong.

# an eternally online collector.

As the "indigenous people" of the Internet, millennials have practiced the attitude of "the Internet is life" in their art collections. Online sales in the global art market reached $6 billion in 2018, up 11 per cent from the previous year. Sotheby's (24%) and Christie's (16.8%), which have seen steady growth in online sales, have made the online business part of their overall strategy to attract new collectors. At the same time, online participation in the art market is expanding. Artsy, one of the largest service platforms in the art market, saw a 40% increase in registered users in 2018, and more users are asking galleries online for art prices via mobile phones.

With the increase in online market sales and activity, there is a great difference in the attitude of different generations of collectors towards online trading of works of art. Both reports show that the age of collectors is the biggest factor affecting whether they are involved in online trading in the art market and how active they are. A survey of more than 600 high net worth people (with more than $1 million in investable assets, excluding real estate and commercial assets) in the UK, Germany, Japan, Singapore and Hong Kong, China, found that. Up to 93% of millennials have bought art from online platforms. By contrast, more than half of the baby boomers between the ages of 57 and 72 have never bought in this way. And as they get older, the higher the price that high net worth collectors who have bought art online are willing to pay, according to the UBS report in Basle. At present, the highest average price paid by people of all ages comes from Generation X collectors between the ages of 38 and 53, which is about $500000.

Up to 93 per cent of millennials have bought art from online platforms, while the highest average price paid by people of all ages comes from Generation X collectors between the ages of 38 and 53, at about $500000.

The US trust report captures the same trend. Of the 892 high and ultra-high net worth individuals in the United States in 2018 (with more than $3 million in investable assets, excluding home use), more than 3/4 (78 per cent) of millennials bought art online. Nearly double the average sample (40%). In addition, female collectors have seen the fastest increase in online art trading, more than doubling from 16 per cent in 2017 to 36 per cent in 2018, according to data from the US market.

Baby boomers may regularly read Artforum, with regular consultants and work closely with one or two galleries. Young collectors are breaking this stable pattern. Through the Internet, they are more convenient, faster and connect with more people anytime, anywhere.Millennials are more likely to focus on artists, art celebrities, new stars, collector friends or art institutions on Instagram than baby boomers, and are more likely to find new artists on social media and join communities with specific Instagram tags. If you are really interested, you can learn more, negotiate or even pay. Older collectors face art history and the art market, while millennials are closer to social media and the art and market in it.

100 per cent of high net worth collectors between the ages of 18 and 21 are active on the Instagram platform, while millennials are as active as 70 per cent at "always", "often" and "sometimes" three intensities.Data source: Arts Economics.

In the UBS Basle report, 100 per cent of high net worth collectors between the ages of 18 and 21 are active on the Instagram platform, while millennials are as active as 70 per cent at "always", "often" and "sometimes" three strengths. The report also says only 13% of millennials have never bought items through Instagram. The trend is becoming more pronounced among today's 18-to 21-year-olds, 30 per cent of whom prefer online trading and 20 per cent prefer to use the Instagram platform.

International auction houses such as Christie's and Sotheby's are promoting (Instagram Stories) before exhibitions, auctions and other important events through Instagram photo releases and "stories", or publicizing the results of high-priced auctions after auctions. A large number of followers have been gained, and followers can also contact this email directly on the home page at the same time. Source: Instagram.

The new lifestyle that has emerged among the Tibetan community has nurtured a new market closed loop based on social media. Through social media, collectors maintain a high frequency with artists, galleries and auction houses, breaking the traditional interactive mode of "artist-gallery-collector" working relationship. Lo ï c Gouzer), the former co-chairman of Christie's postwar and contemporary art, mentioned in an interview in 2018 that at least 80 per cent of the collectors he dealt with followed Christie's on Instagram. Adapting to the habits of millennials, artists, galleries, auction houses and other online art trading platforms cleverly use Instagram, to create suspense before exhibitions, auctions and other important events, or use tags and jump links to direct the flow to the trading page.

On April 1 this year, KAWS painting "KAWS album" (The KAWS Album, 2005) set a personal record of HK $116 million at Sotheby's in Hong Kong. The next day, Canadian pop singer Justin Bieber posted a picture of "KAWS album" on Instagram and received responses from Sotheby's official account and KAWS himself, sparking speculation that he was the buyer of the work. Source: Instagram.

Extensive socializing and active connectivity to all aspects of the art market reflect the importance of a "sense of participation" to millennial collectors, and the collection seems to have more social attributes. Sixty-two percent of millennials in the trust report said the social motivations of collections such as "talking about art" and "making friends in the art world" were important to them. As they get older, this becomes less important, with 47% of Generation X collectors valuing social motivation, compared with 18% for the "baby boomer" generation.

In the mature art market, collection is generally regarded as an individual behavior. Now, with the involvement of social media, millennials with only "weak relationships" have created trends and wonders on social media. They already have the ability to influence the market collectively.

# equal treatment of collectors.

(Evan Beard), (Evan Beard), director of the National Arts Service at U.S.Trust, attended a meeting of acquisition boards at a museum on the west coast of the United States in 2018. Each curator had five minutes to explain to the museum director why the fund should be used to store the art of their choice. Evan Bild found that the curators' speeches had almost nothing to do with the composition, form, or historical background of the work of art. They talked about the race, identity, feminist position of the artist, and how the artist overcame the hardships.

To Evan Bild and the millennials he works for, the positioning of such works is out of date. He wrote that when millennials become the main force in the collection, "identity" will no longer be so novel. Kerry James Marshal (Kerry James Marshall) will be an outstanding artist and will not be particularly regarded as an outstanding black artist.But this does not mean that millennials do not care about groups outside the mainstream of the traditional art market whose potential has not yet been recognized. In contrast, millennials and women with high net worth are more concerned about the impact of their investments on society, according to the American Trust. They grew up in an era when the world was converging and people were constantly connected to each other. Millennials are more likely to be treated "equally".

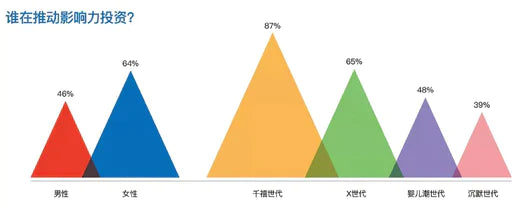

Millennials and women with high net worth are more concerned about the impact of their investments on society, according to the US Trust report. Source: U.S. Trust's 2018 Insightson Wealth and Worth.

Over the past few years, the exaggerated dichotomy between free trade and protectionism, the immigration crisis and national identity has made the necessary and unnecessary identity political debate particularly loud in public life. But millennials' identity with globalisation does not seem to have been shaken by current politics.

According to the analysis of the UBS report in Basle, although collectors cover works from various countries and regions, artists in their own countries or regions account for an average of 55% of their collections, while artists from other countries or regions account for 45% of their collections. This ratio does not vary depending on the sex or wealth level of the collector, and the only factor that changes it is intergenerational.

Compared with collectors of other ages, millennials' artistic taste and collection choices are less influenced by their national identity. In all the countries surveyed, millennials' share of artist works purchased by national or regional artists (48 per cent) was lower than the overall average and lower than their purchases of artists from other countries.

This trend is even more pronounced among Asian collectors. More than 55 per cent of collectors in Singapore and Hong Kong, China collect works by non-local artists. Although reliable data on young collectors in mainland China are temporarily lacking, in (TEFAF Art Market Report: The Chinese Art Market), the TEFAF Art Market report: the Chinese Art Market, released in March 2019, A number of senior industry insiders interviewed by Wu Kejia, a professor at Sotheby's Institute of Art in New York and a Chinese columnist for the Financial Times, have observed that the younger generation of Chinese collectors, in terms of collection aspirations and types of works, It's very different from the choices of our predecessors. They tend to collect contemporary art and the works of artists around the world; influenced by their peers, they are active on Instagram with millennials around the world; without language barriers, they have a direct focus on information about the international art market.

If art platforms and institutions can break through national boundaries, even within the framework of the classification of traditional art history, and look for connections between people, things, and objects to present works, exhibitions, or activities, this will have an effective appeal to millennial collectors around the world.

# Market significance of tags.

With the release of the 2018 Art Market report, the era of millennials collectors has officially arrived.

Millennials, who currently account for 36% of the U. S. market, are the fastest-growing high net worth people; Millennials have the strongest spending power of the countries and regions covered by the UBS report in Basle, accounting for nearly half (45 per cent) of high art consumers (spending more than $1 million) and even 70 per cent in the UK. Millennials are the most active participants in all segments of the art market, even in antiques markets where older collectors are traditionally thought to be more interested and experienced.

More importantly, millennials in the UK, Singapore and Japan are more similar in terms of collection categories and market activity than they are with other age groups in the region. This means that "millennials" are no longer just a convenient term in art market analysis. Since 2018, the word "millennials" has been officially recognized by the most active group of collectors in the global art market. (article / Tong Yaqi)